By means of Howard Schneider and Ann Saphir

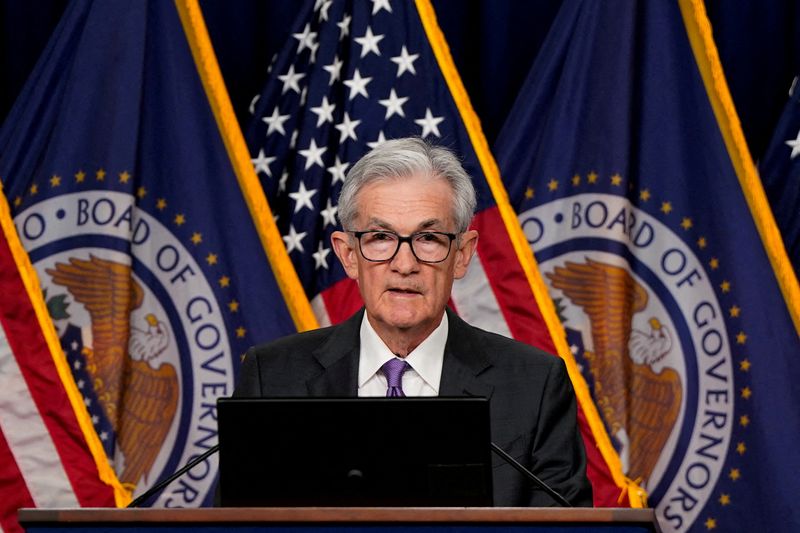

WASHINGTON (Reuters) -The most recent U.S. inflation information is “alongside the strains of what we want to see,” Federal Reserve Chair Jerome Powell mentioned on Friday in feedback that seemed to stay the central financial institution’s baseline for rate of interest cuts this yr intact.

The non-public intake expenditures (PCE) value index information for February, which used to be launched on Friday, “is what we have been anticipating,” Powell mentioned, and even supposing the numbers confirmed much less of a slowdown than remaining yr, “you will not see us overreacting.”

The information remaining month have been “no longer as little as lots of the just right readings we were given in the second one part of remaining yr, however it is indisputably extra alongside the strains of what we wish to see,” Powell mentioned throughout an look on the San Francisco Fed the place he used to be interviewed by way of Kai Ryssdal of public radio’s “Market” program.

Powell’s feedback have been in keeping with his remarks after the Fed’s coverage assembly remaining week, through which he mentioned higher-than-expected inflation in January and February had no longer modified the sense that value rises would stay falling this yr to the central financial institution’s 2% goal.

U.S. Trade Division information confirmed the PCE value index larger at a 2.5% annual price in February, up from 2.4% within the prior month. The quantity except for unstable meals and effort costs rose 0.3% on a monthly foundation, quite sooner than Powell expected when he mentioned remaining week that February core inflation could be “neatly underneath” 0.3%.

Nonetheless, the Fed leader indicated the February record didn’t undermine the central financial institution’s baseline outlook.

Some main points of the PCE information, economists famous, confirmed development in facets of inflation that the Fed considers essential, even because the headline numbers have proven little development within the first two months of the yr.

The central financial institution remaining week held its benchmark in a single day rate of interest secure within the 5.25%-5.50% vary and in addition reaffirmed – narrowly – a baseline projection that the speed will fall by way of 0.75 share issues by way of the tip of this yr.

The Fed is predicted to carry charges secure, because it has since July of remaining yr, at its April 30-Might 1 coverage assembly.

Policymakers by way of then may have gained inflation and jobs experiences for March, and the preliminary gross home product expansion estimate for the primary 3 months of the yr.

Whilst Fed officers had been cautious to mention they do not put a lot weight on any unmarried month’s information, the March readings can have an oversized referring to their coverage dialogue in the event that they verify – or possibly much more in the event that they contradict – an expected activity and salary expansion slowdown and a cooling of housing inflation.

Economists polled by way of Reuters be expecting the March jobs record, which will probably be launched subsequent week, to turn endured robust payroll expansion, with 200,000 jobs added, however with annual salary expansion, at 4.1%, hitting its slowest tempo since June 2021.

Powell in fresh weeks has needed to reconcile expectancies for price cuts to start out this yr with information appearing development within the inflation quantity had slowed to begin the yr.

“We want to see extra” development on inflation sooner than slicing charges, he mentioned on Friday. “The verdict to start to cut back charges is an overly, crucial one … The financial system is robust at the moment, and the exertions marketplace is robust at the moment. And inflation has been coming down. We will be able to and we will be able to watch out about this choice as a result of we will be.”

making an investment.com

![VVS: Meet the Emerging K-Pop Woman Crew Set to Shine Like Diamonds [Teaser Images] – Kpoppie VVS: Meet the Emerging K-Pop Woman Crew Set to Shine Like Diamonds [Teaser Images] – Kpoppie](https://i1.wp.com/kpoppie.com/wp-content/uploads/2025/04/vvs-man-100.jpg?w=100&resize=100,100&ssl=1)

You must be logged in to post a comment Login